does new hampshire have sales tax on cars

New hampshire is one of the few states with no statewide sales tax. States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125.

Is Buying A Car Tax Deductible Lendingtree

Print a copy of that webpage and present it to any entity that requires confirmation that New Hampshire does not issue Certificates for Resale or Tax Exemptions.

. Delaware Montana Alaska Oregon and New Hampshire do not have state sales tax. Only a few narrow classes of goods and services are taxed eg. Our handy New Hampshire Sales Tax guide includes the current rates more.

Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and. New Hampshire Delaware Montana Oregon and Alaska.

I did not pay any tax in MA. Based on the NH numbers you basically pay a reducing of original sales price annually. 18 first year 15 next lowering to 03 in year 6 and beyond.

So assuming you buy a 60K vehicle the taxes registration fees look like this. There are however several specific taxes levied on particular services or products. New Hampshire EV Rebates Incentives.

New Hampshire is one of the few states with no statewide sales tax. Any entity doing business in New Hampshire must pay a business profits tax. Some other states offer the opportunity to buy a vehicle without paying sales tax.

Washington DC the nations capital does not charge sales tax on cars either. No there is no general sales tax on goods purchased in New Hampshire. As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it.

Does New Hampshire chage a sales tax when buying a used car. The most straightforward way is to buy a car in a state with no sales taxes and register the vehicle there. Answer 1 of 3.

While states like North Carolina and Hawaii have lower sales tax rates below 5. There are currently five states that have a 0 sales tax rate. The tax is 76 percent for periods ending on or after December 31 2022.

Most states have car sales tax exemptions especially for cars made before 1973 gifted vehicles and disabled owners. The New Hampshire excise tax on cigarettes is 178 per 20 cigarettes higher then 66 of the other 50 states. Does New Hampshire have sales tax on cars.

The State of New Hampshire does not have an income tax on an individuals reported W-2 wages. However if a business has less than 92000 gross business income it does not have to file a return. No there is no sales tax.

Only five states do not have statewide sales taxes. I live in NH I bought my car in Massachusetts as it was considerably cheaper than in NH for the car I was looking for. New Hampshires excise tax on cigarettes is ranked 17 out of the 50 states.

These five states do not charge sales tax on cars that are registered there. However if you live in neighboring Vermont Maine or Massachusetts you cannot simply go to New Hampshire to buy a car to avoid paying sales tax. If you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car.

States like Montana New Hampshire Oregon and Delaware do not have any car sales tax. This is tax evasion and authorities are cracking down on. Unfortunately unless you register the car in a tax-free state you will still have to pay the sales tax when you register the.

Montana Alaska Delaware Oregon and New Hampshire. Call the Audit Division at 603 230-5030 for additional assistance. For more information on motor vehicle fees please contact the NH Department of Safety Division of Motor Vehicles 23 Hazen Drive.

What states have the highest sales tax on new cars. Does New Hampshire have a sales tax. 15 12 9 6.

However sales tax exemptions for vehicles arent necessary for New Hampshire since New Hampshire does not charge sales tax. But you cannot drive back to NH once you buy. However each of these states regulates its own excise taxes income taxes and taxes on tourist destinations.

You need to come back to NH get. The New Hampshire cigarette tax of 178 is applied to every 20 cigarettes sold the size of an average pack of cigarettes. Looking for the latest New Hampshire Sales Tax rates.

Prepared meals hotel rooms cigarettes motor fuels medical services thats all thats coming to mind off-hand. A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption plus. When Sales Tax is Exempt in New Hampshire.

So while these states including New Hampshire have a 0 sales tax rate they use other. New Hampshire is one of the five states in the USA that have no state sales tax. Answer 1 of 6.

Buy a car in Maryland North Carolina Iowa or.

A Complete Guide On Car Sales Tax By State Shift

Car Sales Tax In New Hampshire Getjerry Com

What S The Car Sales Tax In Each State Find The Best Car Price

When You Buy A Car From New Hampshire Is There Sales Tax Sapling

New Hampshire Car Insurance Laws Bankrate

What S The Car Sales Tax In Each State Find The Best Car Price

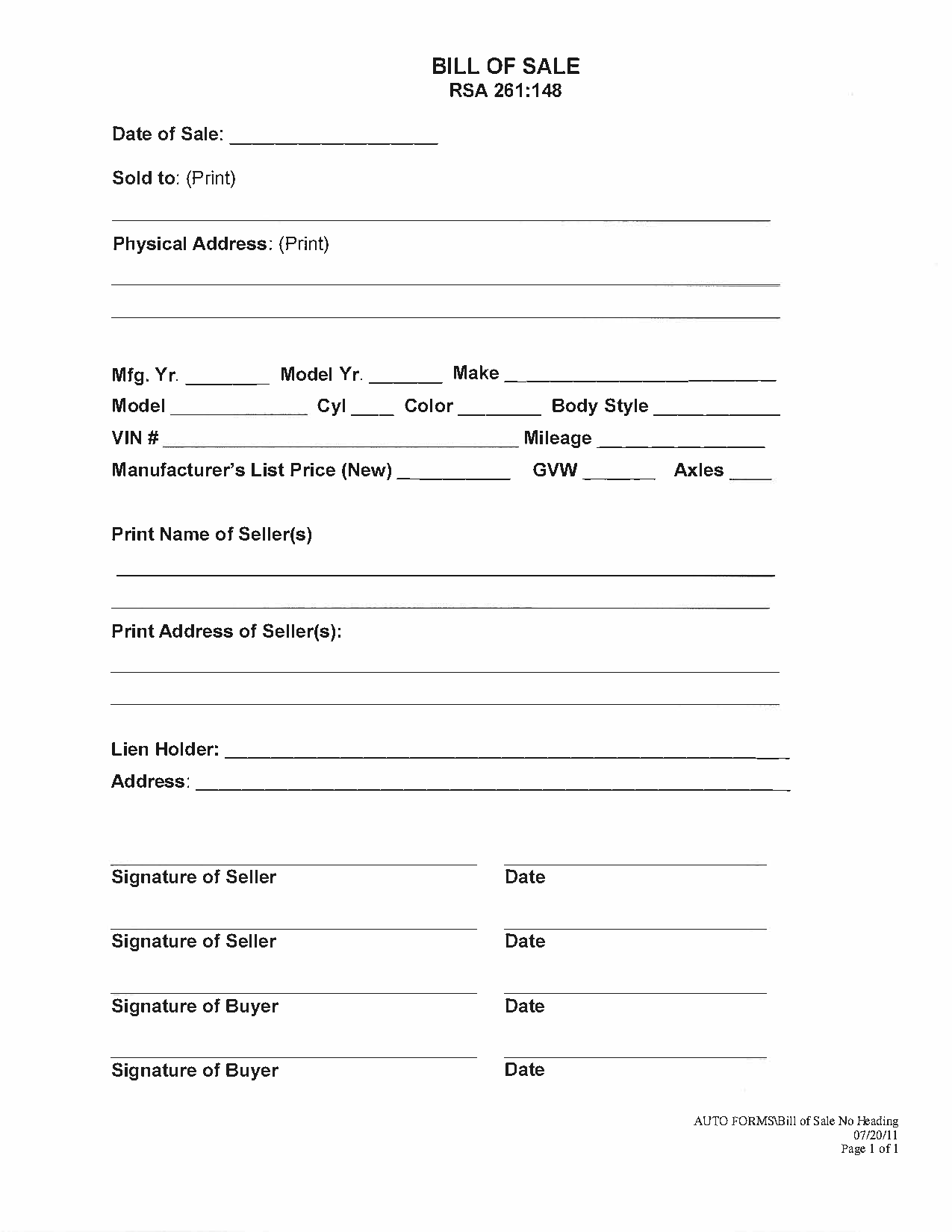

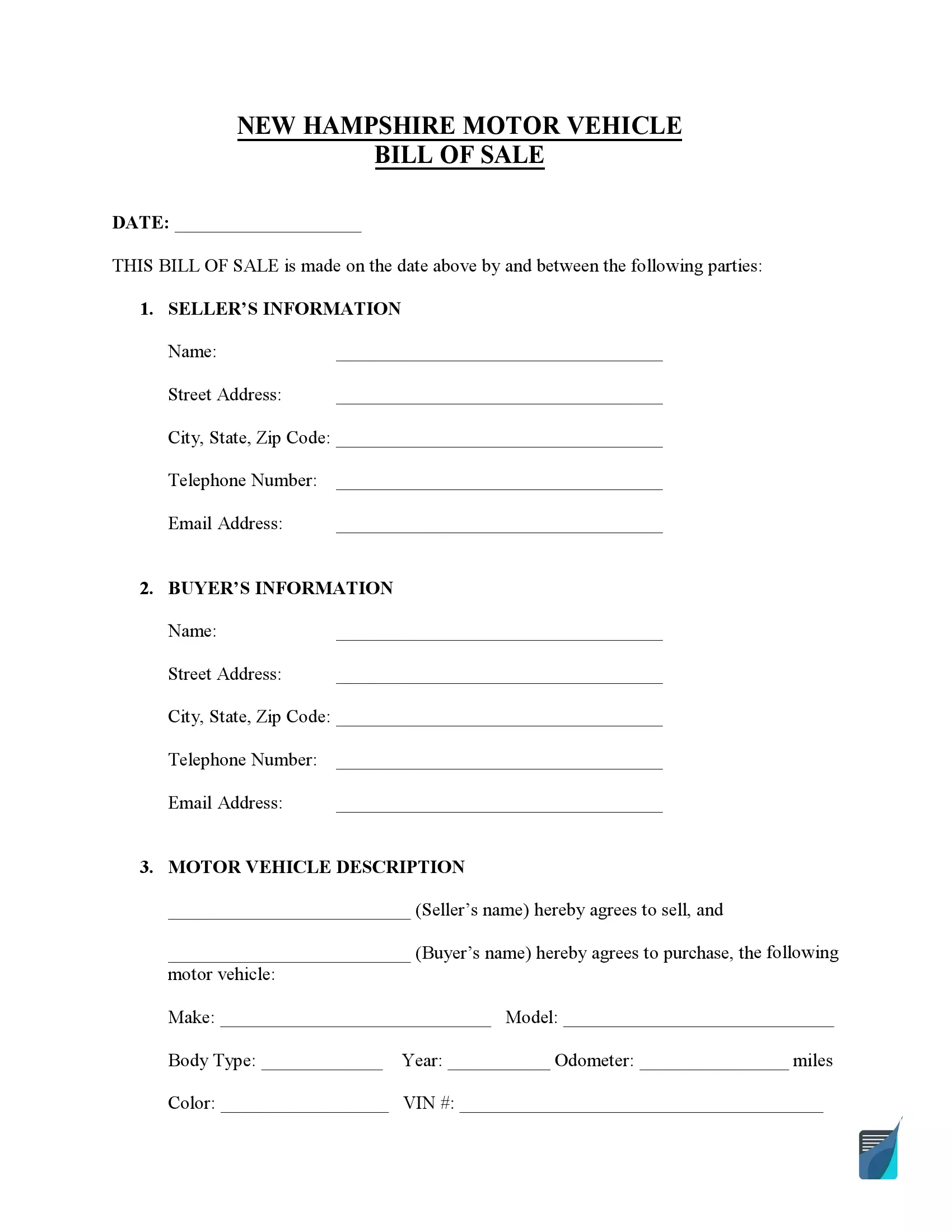

Free New Hampshire Motor Vehicle Bill Of Sale Form Pdf Word

Free New Hampshire Bill Of Sale Forms Pdf

Average Cost Of Car Insurance In New Hampshire For 2022 Bankrate

Free New Hampshire Bill Of Sale Form Pdf Word Legaltemplates

Free New Hampshire Bill Of Sale Forms Formspal

New Hampshire Sales Tax Handbook 2022

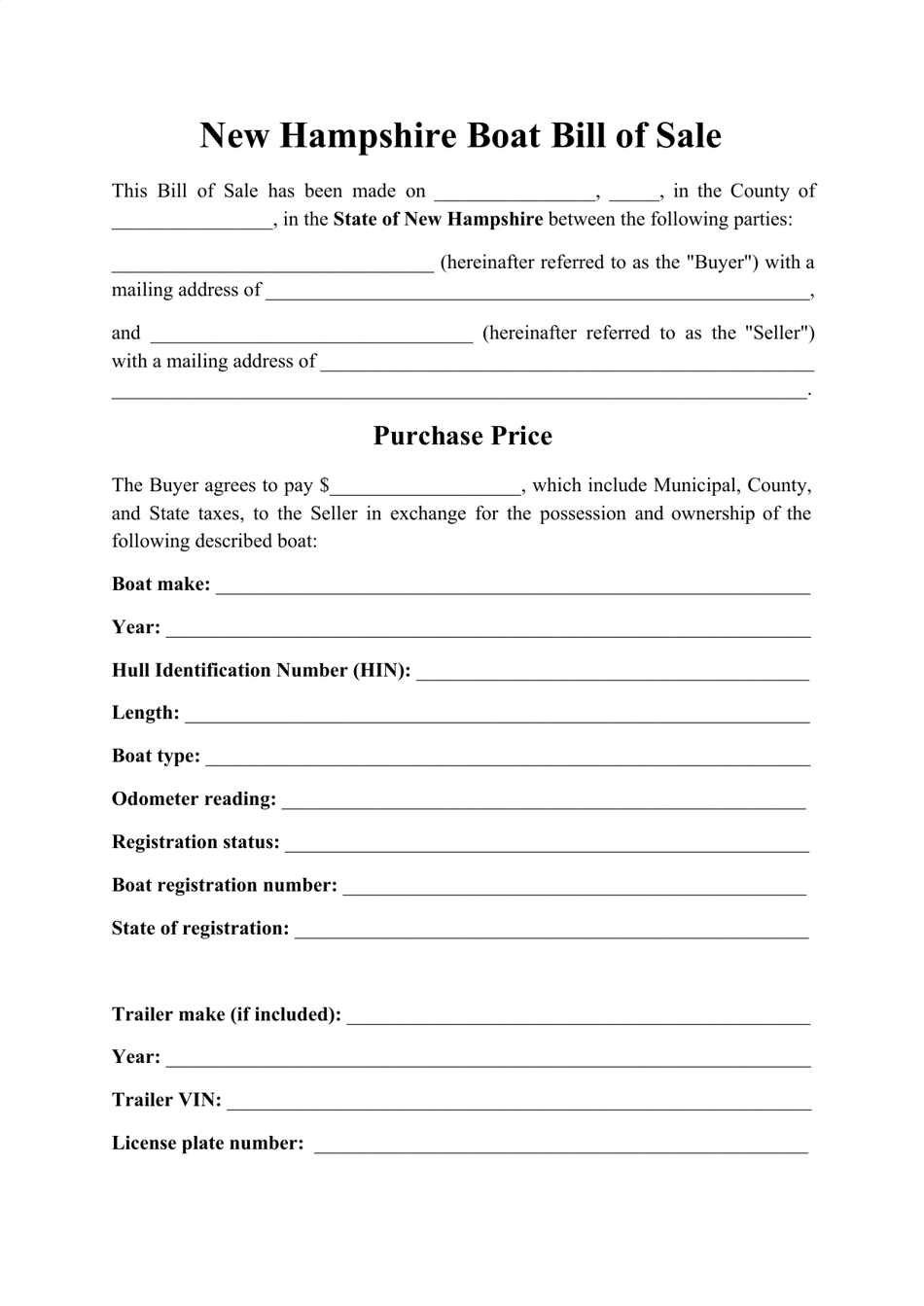

New Hampshire Boat Bill Of Sale Form Download Printable Pdf Templateroller

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

Understanding New Hampshire Taxes Free State Project

Cheapest Car Insurance In New Hampshire August 2022 Wallethub Cheap Car Insurance In Nh Cheap Auto Insurance New Hampshire Cheap Insurance New Hampshire

What S The Car Sales Tax In Each State Find The Best Car Price